Proud partner of ABC MEDICARE, Global Financial Impact, and Private Money Club!

Medicare Supplements

What is a Medicare Supplement?

Medicare Supplements, also known as Medigap policies, are sold by private insurance companies to help you cover the out-of-pocket costs left behind by Medicare.

When you have a Medigap policy, Medicare pays up to its limit on your medical expenses. Then, your Medicare Supplement plan starts to help with covering costs up to the plans limit. That limit usually covers what Medicare didn't, however, that will depend on which policy you select.

What do Medicare Supplements cover?

Original Medicare only covers 80% of your Part B expenses. The other 20% comes out of your pocket if you do not have a Medicare Supplement policy also referred to as Medigap. If you were to have a lengthy stay in a hospital or expensive treatments at outpatient facilities, you can see how that could add up.

Medicare Supplements pay that 20% for you.

Is there anything not covered by Medicare Supplement Plans?

Things that are not covered by Original Medicare on your Medicare Supplement:

Routine dental, vision, and hearing exams

Hearing aids

Eyeglasses or contacts

Long-term care or custodial care

Retail prescription drugs

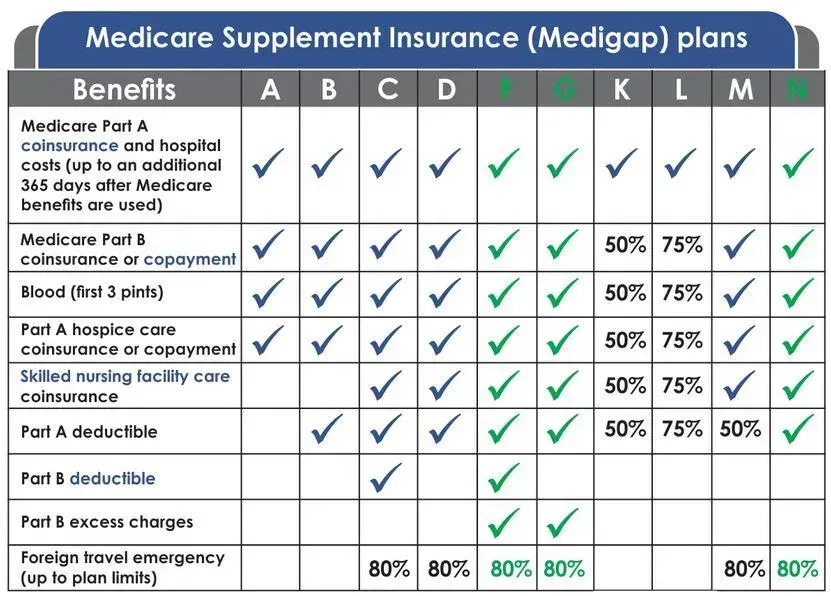

Which Medigap Plans Can I Choose From?

Plan F

Medigap Plan F features the most coverage available of the offered Medicare Supplements.

Plan F covers the following at 100% with the exception of the foreign travel emergency benefit:

-Original Medicare Part A’s deductible

-Part B deductible

-Part B excess charges

-Part A coinsurance and hospital costs up to an additional 365 days after Medicare’s benefits are all used up

-Part B coinsurance or copayments

-First three pints of blood used in an approved medical procedure

-Skilled nursing facility coinsurance

-80% of a foreign travel emergency (up to plan limits)

Because of how much Plan F covers, it has become the most popular plan with close to 50% of clients choosing Plan F for their supplement coverage.

Currently, the only Medicare clients that still have an option to choose Plan F are those who were eligible for Medicare prior to January 1, 2020.

Plan G

Medigap Plan G features the most bang for your buck. The plan is just like a Plan F except that Plan G doesn't pay for your Part B deductible.

Plan G covers the following at 100% after you meet the Once a year Part B Deductible with the exception of the foreign travel emergency benefit:

-Original Medicare Part A’s deductible

-Part B excess charges

-Part A coinsurance and hospital costs up to an additional 365 days after Medicare’s benefits are all used up

-Part B coinsurance or copayments

-First three pints of blood used in an approved medical procedure

-Skilled nursing facility coinsurance

-80% of a foreign travel emergency (up to plan limits)

Plan G is quickly becoming one of the most popular plans available and historically has experienced lower rate increases than it's famous brother - the Plan F.

Plan N

Medigap Plan N is one of the supplement plans that you will find with the lowest premiums due to the increase in cost share between the plan and the client. Below is what would be covered 100%:

-Original Medicare Part A’s deductible

-Part A coinsurance and hospital costs up to an additional 365 days after Medicare’s benefits are all used up

-Part B coinsurance (AFTER a $20 office visit copay)

-First three pints of blood used in an approved medical procedure

-Skilled nursing facility coinsurance

Here is what you would be responsible for if you chose a Medigap Plan N:

-Part B Deductible (Once a year)

-$20 Office Copay

-$50 Emergency Room Copay (unless checked in as an Inpatient at which point the $50 is waived)

-No Part B Excess Coverage

Plan N is quickly becoming one of the most popular plans available and historically has experienced lower rate increases than the Plan F or Plan G.